tn vehicle sales tax calculator knox county

423-279-2725 Other Locations Vehicle Sales Tax Calculator. This is the total of state and county sales tax rates.

Tennessee Vehicle Sales Tax Fees Calculator Find The Best Car Price

Vehicle Sales Tax Calculator.

. Bought car in Florida and paid 6 Florida sales tax. Suite 101 Blountville TN 37617. You can find more.

Crediting Out-of-State Sales Tax Example. For comparison the median home value in Knox County is. There is a 3600 wheel tax in Knox County for all motorized vehicles and cycles.

Knoxville is located within Knox County Tennessee. The minimum combined 2022 sales tax rate for Knox County Tennessee is. Dekalb County James L Jimmy Poss.

This tax does not apply to trailers. This includes the rates on the state county city and special levels. Heres the formula from the Tennessee Car Tax Calculator.

Maximum Possible Sales Tax. Tennessee has a 7 statewide sales tax rate but. Smithville TN 37166 Phone.

Title Fee 1400 Licenses plate fee 29 standard issue plate 7900. Knox County in Tennessee has a tax rate of 925 for 2022 this includes the Tennessee Sales Tax Rate of 7 and Local Sales Tax Rates in Knox County totaling 225. The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Knox County local sales taxesThe local sales tax consists of a 225 county sales.

7 State Tax on the sale price minus the trade-in. Customer located in Davidson County. Tennessee State Sales Tax.

15 to 275 Local Tax on the first 1600 of the purchase. Title and transfer of existing. The average cumulative sales tax rate in Knoxville Tennessee is 925.

The December 2020 total local sales tax rate was also 9250. What is the sales tax rate in Knox County. Tennessee has a 7 sales tax and Knox County collects an additional 275 so the minimum sales tax rate in Knox County is 975 not including any city or special district taxes.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The current total local sales tax rate in Knox County TN is 9250. There are exemptions from the Wheel Tax under certain conditions.

Maximum Local Sales Tax. Knox County Wheel Tax is 3600 and may apply when purchasing a new plate. Average Local State Sales Tax.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Tennessee County Tax Statistics Ctas

Car Tax By State Usa Manual Car Sales Tax Calculator

Tennessee County Clerk Registration Renewals

New Subaru For Sale In Knoxville Tn Grayson Subaru

Ohio Sales Tax Rates By City County 2022

Tennessee Car Sales Tax Everything You Need To Know

Knoxville Mayor Proposes Property Tax Increase In New Budget Wbir Com

2023 Fees Great Smoky Mountains National Park U S National Park Service

Tennessee County Clerk Registration Renewals

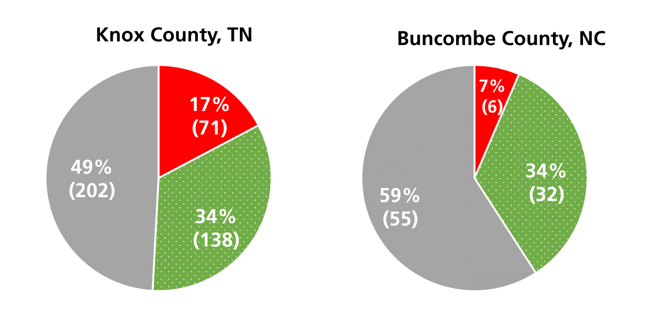

Property Assessments Increase All Over Knox County Wbir Com

Expert Advice For Moving To Knoxville Tn 2022 Relocation Guide

County Clerk Jefferson County Government

Tennessee Budget Primer The Sycamore Institute

University Of Tennessee Knoxville Tennessee Campus Art Map Print Knox County By James Steeno

Ted Russell Nissan New Used Nissan Dealer In Knoxville Tn

Car Tax By State Usa Manual Car Sales Tax Calculator